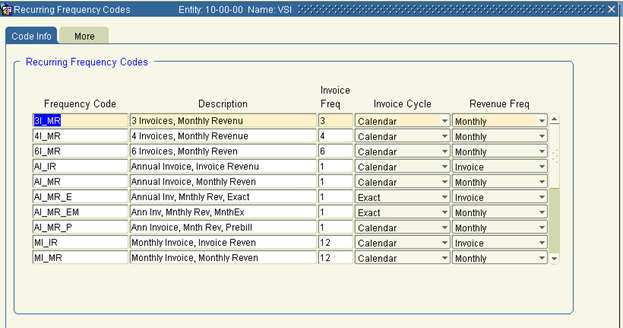

1. Recurring Frequency codes are defined in the screen below, and are used by the Contracts Module to define how often to generate an invoice for a contract, and how to recognize revenue for that contract.

2. Frequency Codes are user defined and are typically created using a convention that indicates the number of invoices and how revenue is recognized. Populate a value for Frequency Code and provide a longer description required to identify its purpose.

3. Populate a value for Invoice Frequency. This means in a 12 month cycle, how many times will the contract be invoiced – 1=Annual, 4=Quarterly, 12=Monthly, etc.

4. Select a value for Invoice Cycle. For contracts which might run on a start date other than the 1st of the month, the Calendar invoice cycle will result in the creation of an initial invoice with one line item for the first partial month, ex: 15-Jan through 31 Jan, and a second line item for the first full month, ex: 01-Feb through 28-Feb. The Exact invoice cycle will result in an initial invoice for 15-Jan through 14-Feb.

5. Select a Revenue Frequency of Monthly or Invoice. Typically this value is set to monthly so that the revenue for an annual contract is recognized in monthly installments throughout the contract year, though the value can be set to Invoice in the event that revenue should be recognized as invoiced – either up front if invoiced in advance, or at the end if invoiced in arrears.

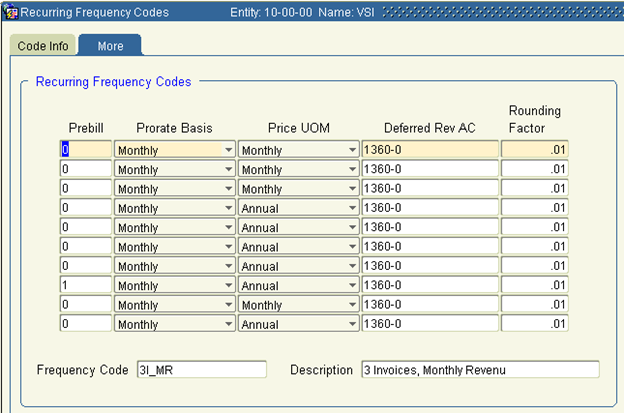

6. Additional fields are available for definition by clicking the More button within the Recurring Frequency codes screen. The canvas below is a horizontal continuation of the Code Info canvas.

7. Frequency codes can be defined with a PreBill value of 0 or 1. Typically frequency codes need not be defined with a PreBill value, though if set to 1, the contract invoice will generate one period in advance – where period is defined by the number of invoices generated. Monthly prebill would be one month in advance, annual would be one year in advance.

8. Prorate basis is used to determine how initial contract invoices will appear in the event that the effective date and invoice start date are not the same – prorate or round to the nearest month, year, or exact.

9. Price Unit of Measure is used to provide a default value for the contract line item – is pricing specified as an annual price, or a monthly price.

10. Define the deferred revenue account which will be used to hold revenue for the full contract year, until recognized to an actual revenue account on a monthly basis.

11. For contract invoicing, round to the nearest dollar, penny, etc. Recommended to always set to .01.