Define/Set-up Foreign Accounts in General Ledger

If you will have Balance Sheet accounts that will transact in a currency other than the Self Balancing Entity Base (Book 1) currency, that would typically be an account you would want to revalue periodically due to foreign exchange fluctuation. The best example of this is a foreign cash account. The value translated to Book 1 at the time of the transaction will change with the fluctuation of the foreign exchange. E.g., $16 MXN may be worth $1 USD today but $1.50 at the end of next month. A revalue should be done to state the current USD (Book 1) value on the Balance Sheet. Refer to U.S. GAAP guidance and/or discuss with your tax and audit advisors for help in determining what accounts you need to revalue and how often. .

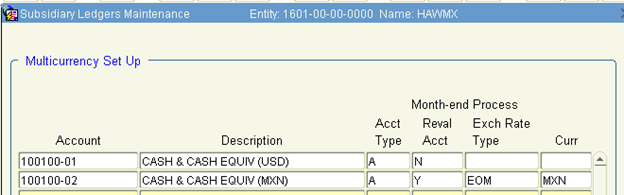

Foreign currency accounts must be established in the multi-currency section of the sub-ledger window. Accounting> General Ledger> Maintenance> Account, Account Groups> Subledgers> Subledgers [MC Setup].

1. Tab to the Exch Rate Type column and enter the Rate Type you setup in Multi-Currency Rate Types for your month end revaluation. In the above example, it is EOM (End of Month).

2. Tab to the Curr field and enter the primary or actual currency the account will trade in.

Note: The Reval Acct field will auto-populate with Y when you enter data in the other fields.