Multi-Currency Transactions

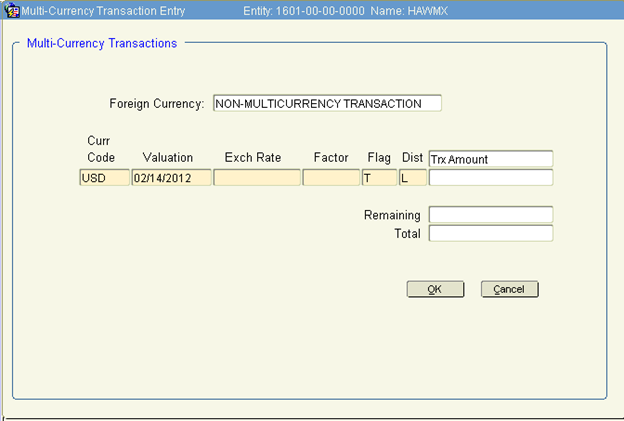

The Multi-Currency transaction window will pop up during transaction entry in modules that interface to transactions to the General Ledger. The window will not pop up if a user's privileges are set to N for .MC Transaction Privilege.

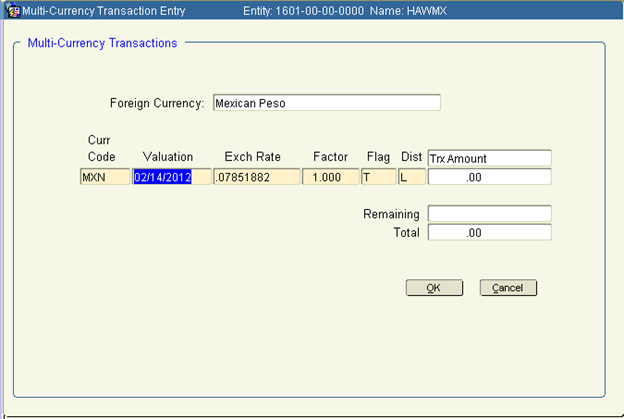

The default will be a Non-Multi-currency transaction with the entity base currency code in the Curr Code field. If the transaction needs to be entered in a different currency because payment to a vendor or an invoice to a customer needs to be in their local currency, etc., change the Curr Code to the appropriate currency. The valuation date and exchange rate will default in based on the approved open rate in the Exchange Rate table for that currency.

In the above example, if nothing is changed, the transaction will store the foreign value based on the exchange rate displayed. It will be stored in the General Ledger tables and sub-ledger interface tables in a field designated for the foreign amount. Book 2 will always be calculated and stored in the Book 2 Amount field for all transactions in the Entity's Book 2 currency based on the same valuation date.

Valuation This date can be changed to the actual date of the transaction to pick up the exchange rate defined in the exchange rate table on that date.

Exch Rate The Exchange rate can be changed (if user has privileges to change rates). An example would be if the transaction originated for a known exchange rate this is different than the table rates for the transaction date. This allows you to force the known base currency amount and the known foreign amount.

Factor Leave as is

Flag This refers to the exchange rate source. The flag associated with all transactions are stored in the database tables. The following flags are available:

T= Khameleon Table rate.

F=fixed rate which might be used if setting up a recurring voucher or invoice and the exchange rate is to remain the same.

S=Spot Rate. To tag the non table rate with for informational purposes about rate used for override..

B=Settlement Based on Base Currency Value. To tag the non table rate for informational purposes about the rate used for override

H=Historical. Available in General Ledger journal entries only. This would be used to force the Book 2 translation value with an exchange rate that does not exist for the valuation date in the exchange rate table.

Example 1: To re-class an amount from one account to another and you want the associated Book 2 value to move as well. Re-classing between accounts should not have an FX effect. Back in to the exchange rate between the Book 1 amount and Book 2 amount. In the MC Window, change Flag to H. this will pop a window for Book 2 exchange rate. Enter the calculated exchange rate.

Example 2: If you need to manually reverse a JE with a source other than GL and do not know the valuation date used in original transaction. Follow same process as Example 1.

Note: Whenever possible, Use the Process Reversal function in Process Journal Entries screen rather than manually reversing an entry that was made directly in GL. The Book 2 will reverse exactly as it went in.

Dist Allows the user to enter the transaction in local (Book 1), the foreign amount of the transaction, or both.

L=Local -The user can enter the transaction in entity base currency (Book 1) and override the exchange rate to force the Foreign Amt to match the transaction source. L might also be used if the Foreign Amt should be adjusted to the valuation date exchange rate.

F=Foreign – Most efficient for transactions that must have an accurate Foreign Amt for payment, invoicing, bank balances, etc. the transaction amounts will be converted to entity base currency so no calculating an exchange rate is necessary.

B=Both – This method is useful if the desire is to control the entity base currency (Book 1) amount and the Foreign Amt.

The MC window pops up when you are keying data in the Header block. The MC window settings will control the actual transactions made in the distribution lines, i.e., AP lines, AR lines, GL lines. If Dist method is F or B the Multi-currency Window will pop up for each line entered to facilitate entering in the value in foreign currency, conversion to Base currency and populating the main screen with that value. Method B is really an either/or option. It allows entry in the Local amount on the main screen and will then pop the MC window and show the calculated foreign amount based on the exchange rate in the MC window. If Foreign amount is changed, the local amount will automatically get recalculated since the exchange rate does not change.

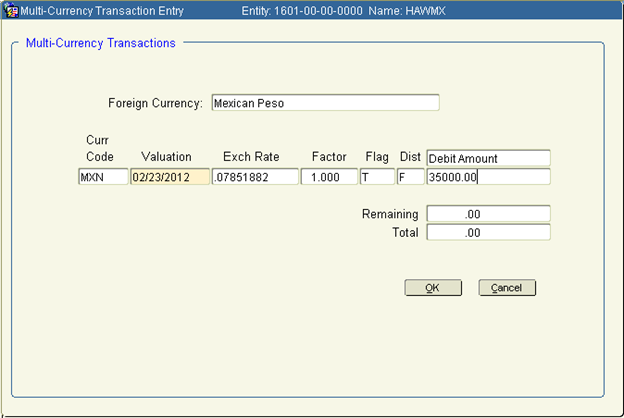

The below example is a Multi-Currency transaction in the General Ledger with Dist set to F. It works the same as described in the above paragraph but allows for entering the Debits and Credits.

1. When you get to the amount field, the Debit screen will always pop up first. Enter the Foreign amount for the 1st line of your journal entry.

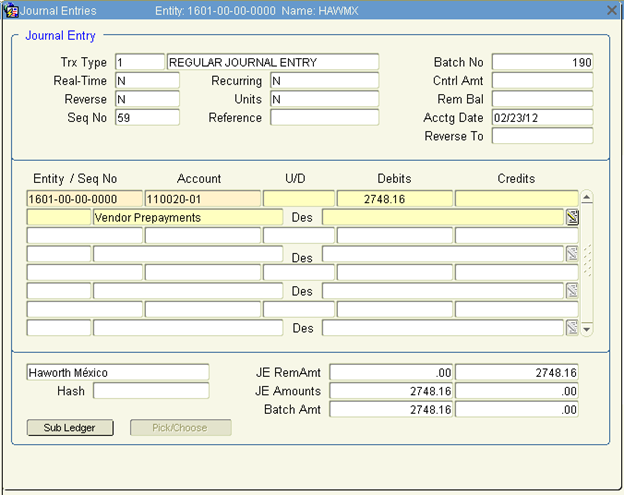

2. Click OK will return you to the Main Journal Entry screen and the Debit amount will display in the entity base currency.

3. Go to the next line and report until your Debits are complete. When done entering Debits, leave the Debit field blank, click OK and the screen will switch to Credit Amount. Repeat for all your credits.

Main Journal Entry screen showing the Debit in Local currency for the 35000.00 Foreign Debit Amount.

Non-GL transactions (AP vouchers, AR invoicing, etc.) work the same way except there is only one amount to be entered per line if F or B are chosen. The offset is done by the system as the total to all lines to the corresponding sub-ledger or control account.