Multi-Currency Rate Setup / Maintenance

Multi-Currency Rate Types were defined in the beginning of the setup. Exchange rates need to be defined for each Rate Type that will be used prior to using them. If a daily current exchange rate will be used, the rate must be setup every day prior to processing. Some companies elect to do a weekly rate and use the closing rate from the prior Friday, others may elect to do a monthly rate and use the average rate from the prior month. The day-to-day processing exchange rate decision should be discussed with your auditor and/or parent company if applicable. Exchange Rates can come from many sources and easily found on the Internet or may even be provided by your parent company (if applicable) or bank.

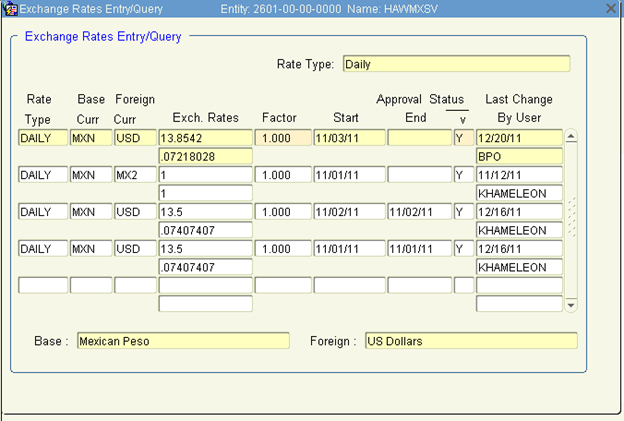

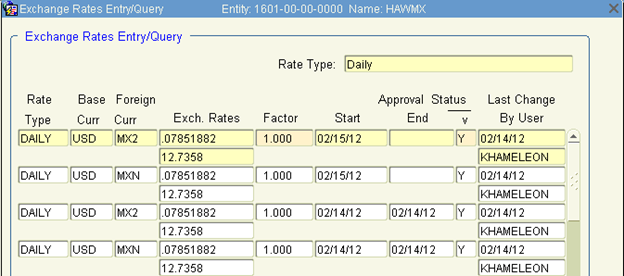

The example below applies to daily exchange rate setup/maintenance. In this scenario, the company has two Self Balancing Entities. One has a base currency (Book 1) of USD and reporting currency of MXN. The other has MXN for base currency and also for reporting currency. The Reporting currency code can not be the same as the base currency code, therefore, in this scenario; MX2 was defined as a currency code for Reporting currency.

Set up exchange rates for the Base currency to every currency the entity will incur transactions in.

1. Enter Rate type

2. Enter Base Currency code

3. Enter Foreign Currency code.

4. Enter Exch. Rates. The rate can be entered in the top or bottom field. Use Tab or ENTER to move to the bottom field and enter the reciprocal rate. Note that the top field represents the ratio of foreign to base (Book 1). In above example, .07851882 US dollars are the equivalent to 1 MXN Peso. The reciprocal is 12.7358 MXN Pesos = 1 US dollar.

5. Leave the Factor at 1. This Factor allows for adding a multiplier for hedging or loading. Most companies would never use this feature in the finance system.

6. Enter the Start Date for the exchange rate. This is the date the rate will be effective for transactions.

7. Entering an End Date is optional. Leaving it open will leave that exchange rate in effect until an end date is entered and met. If daily rates are to be used, an end date equivalent to the start date can be entered. This would prevent users from making transactions on the following day until a new rate is setup. If left open, users can enter transactions and the transaction will pick up the rate with the open end date and that transaction rate can't be changed once processed.

8. Status is Approval status. This defaults to Y. Leave as Y unless you setup future rates you don’t want users to access yet. Leave past exchange rate status at Y as well. This allows users with the appropriate privileges to enter transactions using a Historical rate when appropriate.

9. Last Change by User will auto populate.

If more there is more than one Self Balancing Entity and it has a different base currency (Book 1), you must set those rates as well. You do not need to change Entities. The screen applies to all entities. Sees screen shot below for the example company that has an S/B Entity with base currency of USD (shown above for USD base currency rate exchange rate setup), and a S/B Entity with base currency of MXN. Note that the two entities have MX2 for reporting currency. This will allow for consolidated reporting in Mexican Pesos.

Note that the Exchange rate from MXN to MX2 is 1 since it is really the same currency. This is to establish the base currency (Book 1) will translate to MX2 (Book 2) at the same value. This exchange rate line should never be end dated and only needs to be setup one time for any entity where your Book 1 and Book 2 are the same currency but must have a unique currency code.