Revaluation

Foreign held balance sheet accounts, such as foreign bank accounts, should be revalued on a monthly basis to reflect the translated balance using the current prevailing exchange rates.

Khameleon can perform revaluation as long as the foreign accounts have been defined as indicated earlier in this chapter and that all transactions involving those foreign accounts have been made correctly. All transactions to involving these accounts, must be Multi-Currency transactions so that the Trx Amt field is populated with the foreign amount. All the transactions where the Trx Amt field has a value will be selected. The calculation will be the sum of all the foreign amounts (Trx Amt) in for each specific currency, to arrive at the balance for that account for that specific currency. The system will calculate the Book 1 value based on the Exchange Rate Type in the Setup Companies / Multi-Currency screen. The exchange rate for revaluation should be the exchange rate on the last day of the fiscal month being processed.

The revaluation process will calculate the difference between what the current Book 1 balance is and what the adjusted Book 1 balance should be. A system generated journal entry will be made for that difference to the unrealized gain / loss account defined in the Setup Companies / Multi-Currency screen. The journal entries will automatically reverse the following month.

Revaluation should not be run until all transactions for the fiscal month are complete, at least to the foreign accounts identified for revaluation. If it is necessary to redo the revaluation (late entries / audit adjustments, etc.), the original batch must be reversed first. This can be done using the Ledger> Processing Journal Entries [Process Reversal].

System calculation / journal entries will also be made to adjust the Book 2 to Book 1 value. For example, a Book 1 account balance could be 0 and the Book 2 could be something other than 0 due to foreign exchange fluctuation over time. The system would make the appropriate adjustment to Book 2 so it would also be 0.

In summary, the revaluation process automatically books adjustments to the fiscal period the process is run for to adjust account balances and Book 2 to state values at current prevailing exchange rates. (Rates must be setup in Multi-Currency> Maintenance> Currency Code Rates discussed earlier in the chapter.) The adjustments are automatically reversed in the following fiscal period. The entire recalculation for the revalue accounts is repeated each time the revaluation process is run.

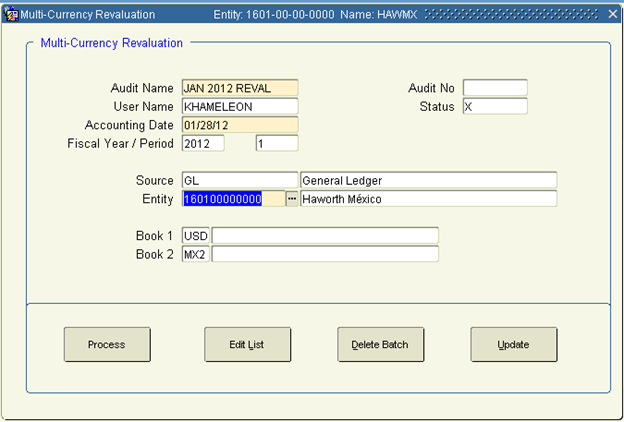

From the Main Menu go to Multi-Currency> Processing> Multi Currency Revaluation (optional)

1. Enter an Audit Name (batch name)

2. User name will default

3. Enter the Accounting Date. This should be the last process for the fiscal month and the accounting date should be the date of the last day in the fiscal month. Note that in the above example, the fiscal month ends 1/28/12. The Fiscal Year / Period will display which help ensure the correct fiscal / period is being processed for organizations that are not running calendar fiscal periods.

4. Source will default

5. Enter the Entity by using the List of values and selecting a Self Balancing entity. Only one entity per batch can be processed.

6. Click Process. Once complete, click and review the edit list.

7. Assuming there are no issues, Update the batch.

8. If there is an issue, such as the need to make a last minute transaction that will impact one of the foreign accounts subject to revaluation, you can delete the batch on this screen if it has not been updated.

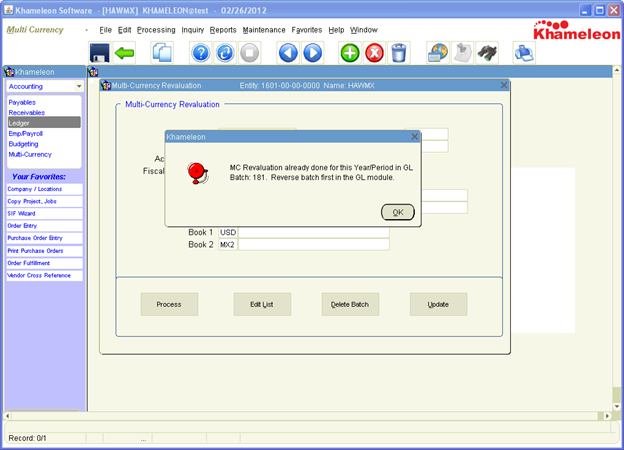

If the revaluation process was run and updated and an attempt is made to run it gain for the same fiscal period, the following message will occur:

The batch number is identified. As mentioned previously, the batch (revaluation journal entries) must be reversed in the Process Journal Entries screen. Then the system will allow re-running the revaluation process for that fiscal period again.

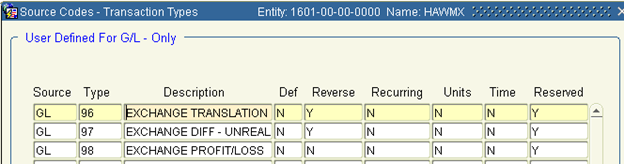

The system revaluation journal entries and the system journal entries made during day to day processing involving settlement of foreign transactions will be recorded in the ledger with the following Transaction Type Codes. Each corresponds to the accounts defined in the Setup Companies / Multi-Currency Screen.