Reverse Cash Receipt

Use this process if a cash receipt was entered in error. E.g., to wrong customer, applied to wrong invoice, wrong accounting date, wrong amount, etc., and it is necessary undo the original transaction and apply correctly.

Example 1

In the first example, the original cash receipt was received on 01/02/12 and applied to Customer 31, invoice # 10300. The cash receipt was $500 and the invoice it was applied to was for $530.97 leaving a balance of $30.97. The cash receipt was intended to relieve invoice # 10555.

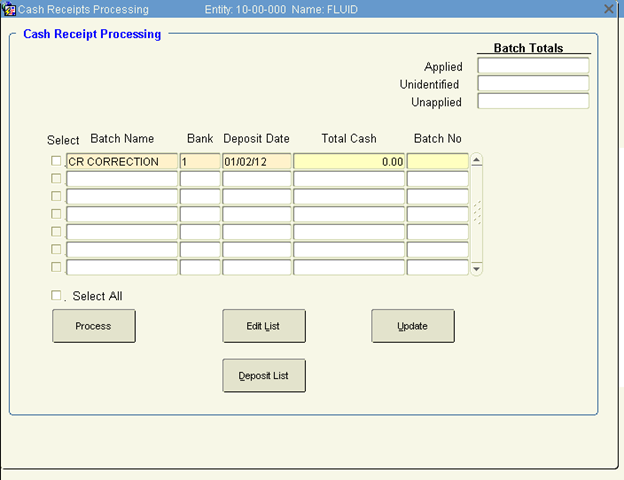

1. Create a cash receipt batch as you normally would. The amount depends on if the reversal and correction will be for the same amount and what the impact to the Bank account is. The amount filed on the Cash Receipt Processing batch screen is informational. Once in the batch, the Check Amount entered in the header is where this will be important.

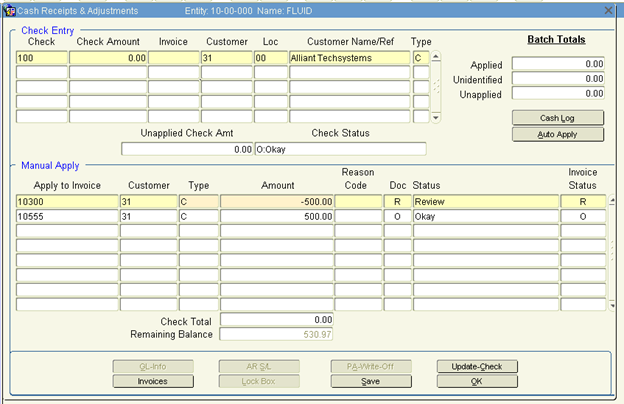

2. The cash receipt was from customer 31 and the net impact to the bank account is $0, only one Check header is necessary. Enter the customer Chk #, 0 for amount and the Customer # and then move down to the Manual Apply block. Key in the Invoices numbers or use the list LOV (list of values drop down).

Enter a -500 to invoice 10300 to back out the $500. Enter a positive $500 to invoice 10555 to clear it from AR.

3. Print Edit list to verify transactions look correct. Update batch.

Example 2

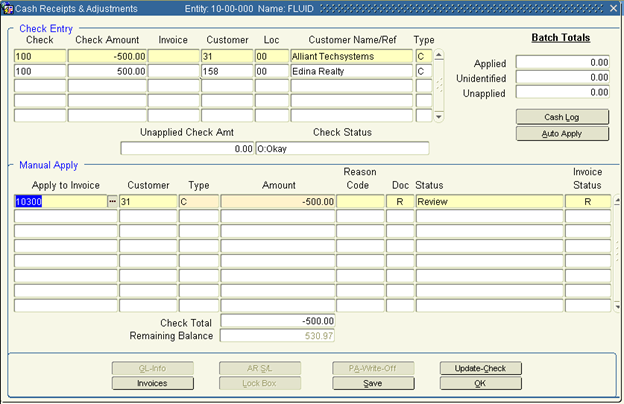

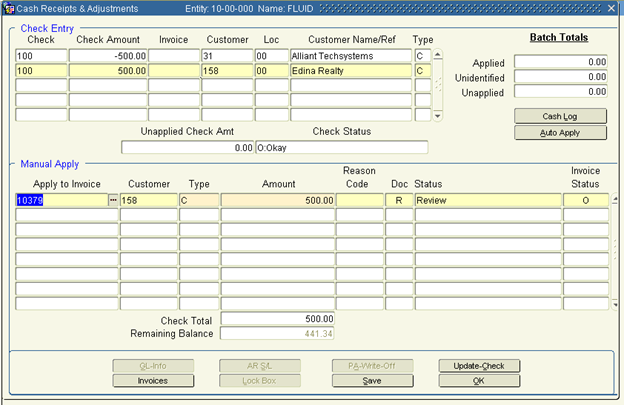

In the next example using the same cash receipt and original cash application but correction is the cash should have been applied to customer 158, invoice # 1037.

The Check header will now require one for each customer and the Check amount will be -500 for customer 31 and 500 for customer 158. Enter the invoice transaction applicable to each Check Header just as with entering multiple cash receipts in one batch.

The above lays out the basic concept of cash receipt correction. Refer to the below for guidance on other possible cash receipt corrections.

Wrong Accounting Date |

In less there is a business/accounting reason to do otherwise, the reversal side of the correction should always be to the same accounting date that the original cash receipt entry was made. This will clear the transaction in the GL in the bank account on the same accounting date. Re-enter the cash receipt in a separate batch using the correct accounting date |

Wrong Amount |

Most accountants would prefer the transactions to match the actual cash receipt / bank statements. Therefore, rather than entering a cash receipt for the difference (which is an option), it is best to reverse the original in one batch and then re-enter the correct cash receipt in a separate batch. |

The same methods would be used for reversing Non-AR cash and Un applied cash (cash on Account). For Non-AR, make sure to enter an N in the Check Header.

Note: Cash Receipt corrections should always be done using the accounting date of the original transaction when the impact to the Cash and AR accounts is net $0. This may require opening a previous calendar period to allow the transaction to flow to the GL. When in doubt, find out what the expected accounting transaction outcome should be. If the correction is that the original went to wrong Accounting date, the reversal side of the correction should still go to the accounting date of the original cash receipt but the correction side should go to the correct accounting date. See Wrong Accounting Date above.