Clear Cost WIP batches are created at the time the AR Invoice Batches are updated. You can choose to have these batches to Auto-Update Clear Cost WIP batches by the following:

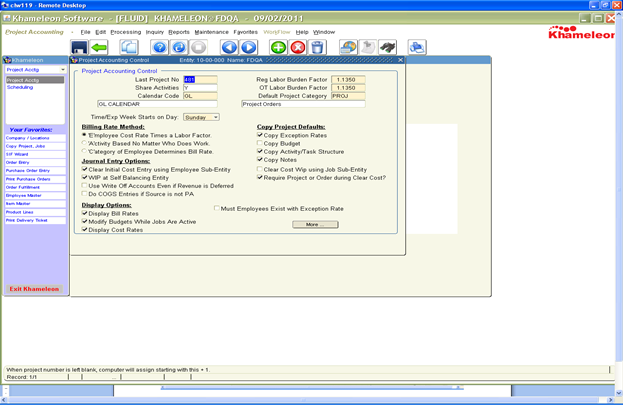

Project Accounting>Maintenance>Control>Control Record-PA>Click the [MORE] button

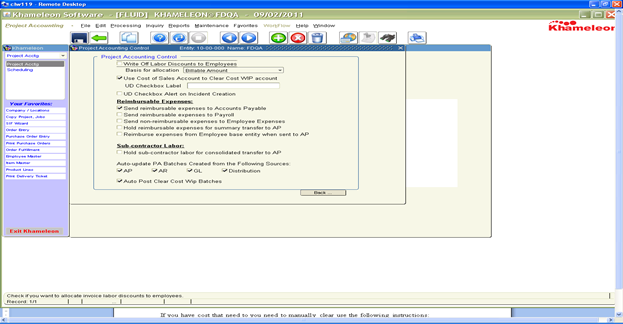

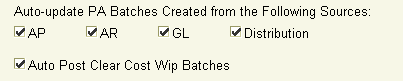

At the bottom of the screen click the box “Auto Clear Cost WIP Batches”

If you have cost that need to you need to manually clear use the following instructions:

Project Accounting: Clearing Cost WIP

You may select or de-select projects and/or jobs to clear quantities and amounts from the cost WIP account (not revenue WIP) and debit the Cost of Goods Sold account. Only jobs with Clear Costs = ‘Y’es are eligible for selection. For non-milestone invoice, this process happens automatically during the invoicing process.

From the Main Menu, go to Project Accounting>Project Accounting>Reports>Project Analysis>Cost WIP with Revenue Report. Run this prior to clearing costs. You can use this to clear items and/or after clearing the costs, run your edit list to see if it ties and you have selected everything that is available to clear.

Automatic Clear Cost WIP Update

An option exists in the Project Accounting Control record (Project Accounting/ Project Accounting/ Maintenance/ Controls/ Control Record – PA)

When checked, ANY Clear Cost WIP batch, automatically created during the Invoicing Process, is automatically updated to the system.

Manually Clearing Costs

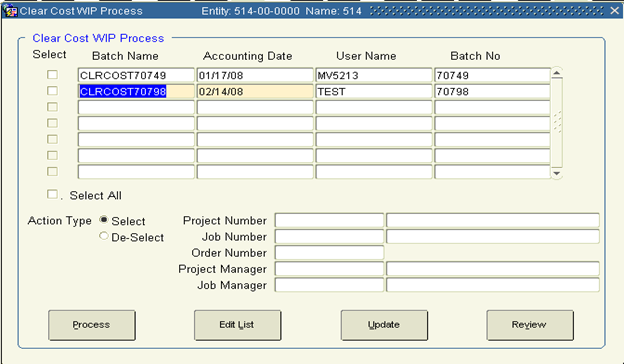

From the Main Menu, go to Project Accounting>Project Accounting>Processing>Clear Costs.

3.

Click  to create a new record.

to create a new record.

4. In Batch Name, use the standard naming convention:

Example: NNNMMMDD??

NNN — User’s first, middle, and last initials

MM — Current month

DD — Current day

?? — Batch sequence number (01, 02, 03…)*

Each batch created by a user during the day should be created in sequence, using a different number for all types of transactions. (DO NOT restart sequencing for different types of transactions.)

5. The rest of the fields should be populated as indicated below:

User Name Your user ID.

Action Type Leave the Select button active.

Accounting Date Reflects the date of the invoice. May be modified.

Project Manager Leave blank.

Job Manager Leave blank.

Project Number Leave blank.

Job Number Leave blank.

Order Number Enter, or use the LOV to select, the appropriate project order number for each invoice generated above. (Enter a specific order here because you do not want to do clear Cost WIP for all.)

6. Click Process. The system will notify you when the process is successfully completed.

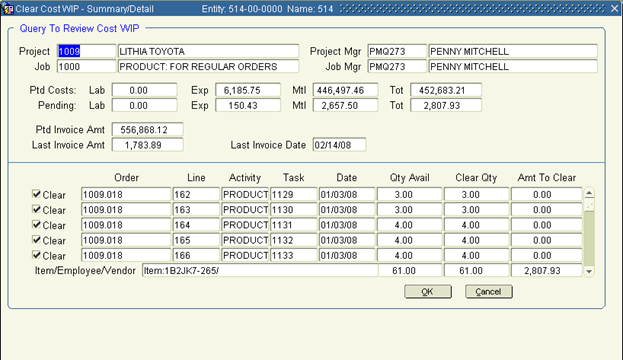

7. To review and/or edit your selection, click Review.

8. Check to see that the amounts in Amt to Clear are correct.

9.

Click  to exit the Review screen.

to exit the Review screen.

10. Multiple records may be cleared within the same batch. Enter your next Order Number to clear.

11. Run a total of the invoices that you are clearing Cost WIP on to get a total revenue amount. Run the Edit List for your batch. Go to the end of the report to view the Grand Total Clear Amount Column. This should be less that the total revenue of invoices to represent a reasonable profit margin. Review the Edit Report for all projects to be sure they are reasonable. Also tie this to the Cost Wip with Revenue report that was run above to make sure all items available were selected. The total of your edit report should equal the Cost Wip with Revenue report if you have selected everything that is available.

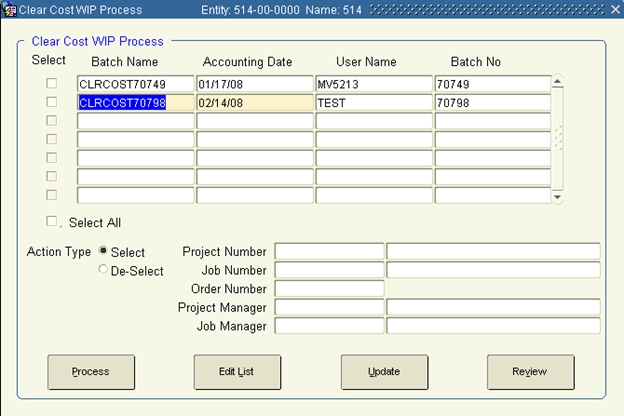

This process assumes the clearing of Cost WIP was acceptable and you now wish to update so that detail and summary information may be viewed.

1. Check the Select box that corresponds to the batch numbers you want to post (update).

2. Click Update. The system will notify you that it's about to post the batch you've chosen. Click OK

3. When the process is finished, the audit(s) you chose will no longer appear in this screen. The Cost WIP data is now ready to post to the General Ledger. The GL Interface Un-posted Transaction Detail Report enables you to review the information in an updated Cost WIP batch before it is posted to the General Ledger module.

4. Exit the form.

**CRITICAL NOTE**

When pairing Order Entry records with the Project Accounting module, the Khameleon best practice recommendation is to create / copy new Projects from a Model project which carries the preferred breakdown structure of jobs, but that carries no default activities. This set up will force the use of Order Lines as the only mechanism for creating available labor and expense activities on a particular engagement. When lines are added to an order which is tied to a project job record – a distinct activity task will be created to capture the cost on that order line item based on the default values defined at the Item Master.

When default activities are present in the Model project jobs, users have the option of costing to activity records which are not linked to an Order. This can lead to missed costs and WIP reconciliation problems.

Service Item kits can be used to simplify the process of entering labor lines for end users in cases where a detailed work breakdown structure is required for an item like Design. While it is recommended that the levels of detail be kept as simple as possible, Kits can be used to auto-include additional detail levels like Design Drawings, Design Revisions, Design Walk Through, etc. Please see the associated CRITICAL NOTE chapter on the use and configuration of Kits.

As a general rule, labor costs are captured through Project Accounting time entry – either by the employee doing the work, or by a centralized user entering time on behalf of employees doing the work. Expense costs in Khameleon are captured by Employee Expense Entry, manual journal entry to a Project Accounting sub ledgered account, Purchase Order receipt, or Accounts Payable voucher distribution. These costs captured in Project Accounting are maintained and updated in the Order Entry Lines tab as ‘Actual Cost’.

Time and Expense Entry in the absence of Order Line items is most typically used when organizations need to capture hours or expenses against activities that are not related to a billable client engagement. The recommended best practice for these situations is to create an Admin or Overhead project, with jobs defined for each particular sales division or department, having activities defined at the level to which costs need to be captured. Examples of labor activities might be Travel, Training, PTO, Sick, Holiday, or expense examples of Hotel, Air, Auto, Meals. Admin or Overhead projects would not be set up as billable, and journal entries would be dictated by the use of Job Cost Codes.