In Accounts Receivables>Maintenance>Codes>Tax Codes

An EXACTOR tax code record exists, but the G/L Account must be entered. Go to the G/L Account field and select the appropriate account.

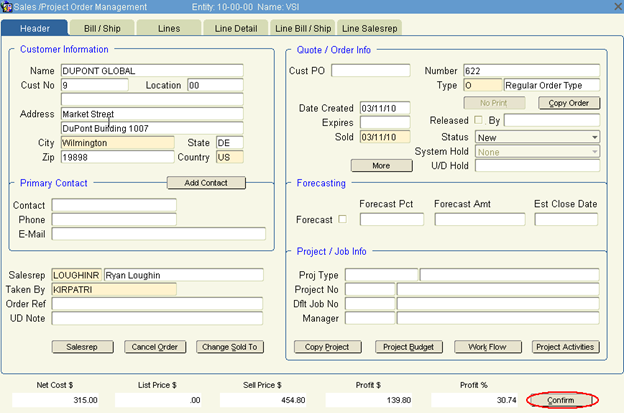

Orders

Tax calculation on an order is done during the order confirmation process. First, click the Confirm button.

Then click the ‘Tax Calc’ button. This will send the order information to Exactor and result in tax being calculated. Either a message saying the calculation was successful or that errors have occurred will be displayed.

NOTE: Exactor has a limit to the amount of data it can process in one transaction. Orders should be limited to no more than 1,500 lines. You must have an active Internet connection for Exactor to communicate the tax calculation back to Khameleon.

To view a summary of the tax calculations for the order, click on the ‘Tax Info’ button. This will show the tax type code (if any) for the lines, the tax rate and tax amount. If there are errors, the error for the line will display in the ‘Error Message’ field. The summary for each line can also be found in the line detail tab of the order.

To view the summary for a line, go to the line detail and click ‘Tax Info’ in the bottom right.

The tax rate and amount will display. If any errors occurred while calculating tax, those errors will display in the ‘Error Message’ field.

At any time, the user may log in to their Exactor account and review the Tax Calculations that were done for an order. After logging in, open Reports>Tax Calculation Requests . This menu brings up a list of all tax calculation request from Khameleon. For details on sorting, filtering, and reviewing this report you can open the Exactor User's Guide under the “Help” tab on the website.