Changes have been made to Milestone processing and setup. A new ‘Milestone Type’ field has been added with three types:

Milestone

This is the default setting and the system processes, as it does currently.

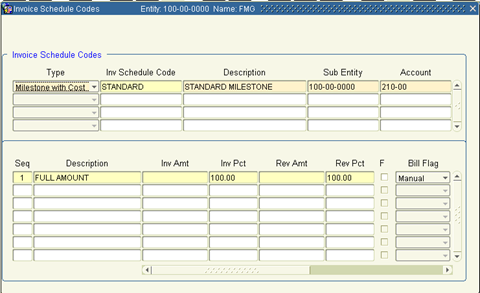

Milestone w/ Cost

For ‘Purchased Items’, this new option allows users of Project Orders to not only recognize Revenue, but also the Cost of Goods Sold (COGS entries, based upon the percentage of Revenue entered at the Milestone Sequence. The other option is to use the ‘Build Invoice Detail’ function to specifically select lines to Invoice. In this case, Khameleon will recognize the cost, based upon the quantity selected to recognize revenue against.

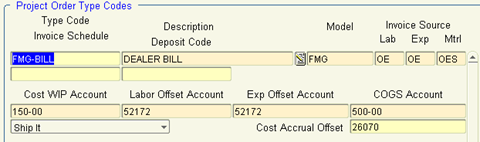

Based upon the items with Revenue recognized being in WIP, Khameleon will Credit WIP and Debit the associated items COGS. Khameleon also allows COGS to be recognized, prior to product receipt and those items being in WIP. A new ‘Cost Accrual Offset’ account has been added to the Project Order Type Codes (Distribution/ Sales Orders/ Maintenance/ Codes/ Project Order TypeCodes) that will be used in the situation where Revenue recognition is happening, prior to receipt. This should be a liability account.

If Khameleon is recognizing revenue and the item has not been received, Khameleon will create the following JE:

DR COGS – Associated with the item being invoiced

CR Cost Accrual Offset account

During the eventual receipt of this item, Khameleon will create the following JE:

DR Cost Accrual Offset account

CR Accrued Liabilities (found in the PO Control record)

Users who want to ensure that all costs are flowing through WIP, may use the ‘Final’ checkbox (F) on the Milestone sequence where they're recognizing Revenue. This requires that all items on the sequence being invoiced have been Received and Fulfilled, prior to processing.

These entries would be the same as above, with instead using the WIP account and the Receipt entries happening first.

Note: Khameleon will allow you to use a combination of both WIP and Cost Accrual entries. If costs are in WIP at the time Revenue is being recognized, those costs are cleared from WIP, instead of Cost Accrual.

Important: If your system is not configured for WIP transactions to happen at the Self Balancing Entity level (option in Project Accounting Control), this Cost Accrual Offset account must be defined for each Sales Department in your General Ledger Account Maintenance.

During the ‘Update’ function the entries related to Cost may be found in the Project Accounting module.

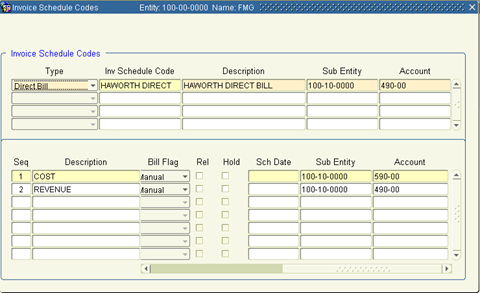

This Milestone type is specific to Office Furniture dealers. Dealers have the need to process orders on behalf of manufacturers they work with. The dealer places the order, purchases the product, acknowledges and receives the product, but the Manufacturer Invoices the customer directly. The dealer is paid a ‘Dealer Service Fee’ (DSF) or Commission for their part. Khameleon uses Milestones to allow the dealer to direct the Revenue and Cost entries to the appropriate General Ledger and Entities, based upon the Milestone Template (Distribution/ Sales Orders/ Maintenance/ Codes/ Milestone Templates).

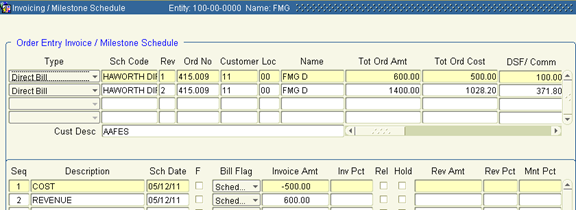

Project Orders should be SIF’d using the Sell to the end Customer, with the Cost being the Sell, less the DSF %. The total GP% and $ should then be the estimated Commission amount.

During the creation of the order, Khameleon will build a specific Milestone for the order and automatically populate the dollars on the Milestone with the appropriate Cost and Sell for the respective Milestone and Revision.

During the Invoicing process, both Sequences (Seq) should be selected. Khameleon will offset the DR to the ‘Cost’ sequence (negative amount) to the CR ‘Revenue’ sequence. The ‘Net’ Invoiced is the ‘DSF’ or Commission amount. The GL Revenue accounts contain their respective amounts.

Note: These should be unique accounts within your General Ledger account setup. For some financial reporting you may want to ‘Net’ these accounts together to not overstate Revenue and Cost of Goods Sold.